36 Business Expense Categories For Small Businesses And Startups

Content

The most common non-cash expense is depreciation, but asset write-downs, such as for obsolete inventory, and stock awarded as compensation are other examples. Expenses are either operating expenses or non-operating expenses. Non-operating expenses, such as interest payments, are not incurred as part of a company’s core operations. Within those buckets, expenses are either fixed — they generally don’t change during the year — or variable, meaning they fluctuate.

SwipeSimple Card Reader Mobile card readers that make fast, secure transactions a reality even when your business is on the go. Branded Gift Cards Boost your brand’s visibility to drive sales higher than they’ve ever been before with gift cards uniquely designed for your business. Merchant Cash Advance Get fast access to cash to grow your business without ever taking out a bank loan. Surcharge Program Designed to offset your payment processing costs, our surcharge program is both convenient and compliant.

Operating Expenses: A Complete Guide

Operating expenses are summarized on a company’s income statement. Every company has different operating expenses based on their industry and setup. Operating expenses are the expenses that a company incurs in generating operating revenue. It could also be explained as the expenses incurred to run the core operations of an organization. When you buy or sell goods and services, you must update your business accounting books by recording the transaction in the proper account. This shows you all the money coming into and going out of your business. Sort and track transactions using accounts to create financial statements and make business decisions.

Expenses are more immediate in nature, and you pay them on a regular basis. They’re then shown on your monthly income statement to determine your company’s net income. While expenses and liabilities may seem as though they’re interchangeable terms, they aren’t. Expenses are what your company pays on a monthly basis to fund operations. Liabilities, on the other hand, are the obligations and debts owed to other parties. Talus Pay POS Everything from basic payment processing to inventory management and customer management—even for multiple locations. PAX A920 Terminal Customer-facing terminals that are easy to use, EMV-ready, and chock-full of convenient functionality.

The following sections describe the common types of costs that are typically included in the operating, general and administrative expenses. This is the default category for any expenses that cannot be directly identified with the cost of sales, selling expenses, finance cost, or taxation.

How To Categorize Business Expenses

If you own the property your business is situated on, or work out of your home, you still want to track those expenses too. Business supplies are tangible items like pens, paper, staplers, printer ink and postage. You should also consider listing office furniture here, as some of it may be tax deductible depending on the cost. You can categorize your expenses for small business by developing a list of popular headers that each charge can be assigned to.

Certain productions costs, such as the overall price of goods or the subscription payments on development software, also qualify as operating expenses and can be reported as revenue expenditures. You’ll also be able to claim the tax savings available for your company. Many business expenses are tax-deductible, returning vital funds to small business owners when tax time rolls around. Using clear business expense categories helps you identify opportunities to save, and much more. Some business owners don’t have an income statement for their business, or their income statement doesn’t separate expenses into cost of goods sold, operating expenses, and non-operating expenses. In this case, you can still get a sense of how much it costs to run your business. Simply review your general ledger or expense report and identify any recurring costs that aren’t the direct labor and raw materials that go into producing a product.

What Can I Deduct?

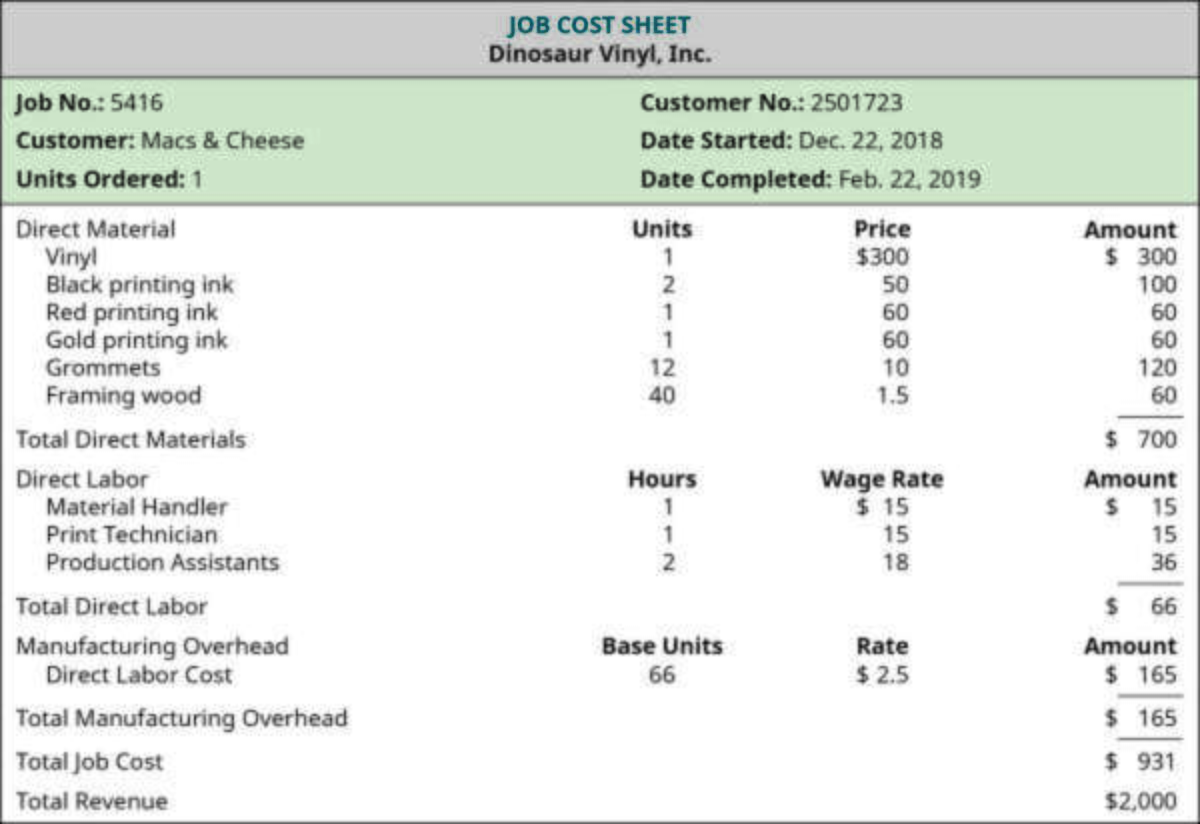

The calculation of the cost of goods sold is pretty straight forward for retail businesses, as you can learn from the example below. CGA notifies the Department Manager of the review and advises they may request supporting documentation. Involve a change in use of goods or services, originally allocated to one project and is now being moved . Full explanation must be provided as to the basis of the transfer. All expenditures must be in compliance with University policies and the requirements of the funding source. Audit-derived disallowed costs will be borne by the unit that caused them. QuickBooks Online is the browser-based version of the popular desktop accounting application.

Transactions can be summarized into similar group or accounts. A company compiles a list of accounts to make the chart of accounts. Client entertainment- Small business owners often spend a lot of time entertaining potential or long-term clients over lunch or dinner. Supplies- While the specific supplies that are required vary depending upon the business, most small businesses require basic equipment, such as pens and paper. Other common supplies and equipment that are needed include computers, fax machines, and printers. Recurring expenses are less certain so they feel a little harder to cut. Knowing what these expenses are and knowing how they affect your budget are two different things.

Are Expenses Liabilities? How To Tell The Difference

An example of a miscellaneous expense is the cost of staff uniforms. Organizations need to insure their assets against a range of adversities, such as the outbreak of fire, earthquakes, theft, and diseases. The annual depreciation expense will be $1000, which is calculated by dividing the building’s depreciable value ($100,000 – $80,000) with its useful life . The cost of renting property of any kind is charged as a rent expense. When promotion and marketing expenses are significant, it is more appropriate to show them separately from selling and distribution expenses. Operational costs of distribution, such as the cost of fuel used in making deliveries to customers.

There are two types of accounting methods. (1) Cash method: allows taxpayers to match income and expenses to the period in which cash receipts and payments occur. So, it recognizes transactions only when cash is exchanged.

— Finance Turtle (@ustaxturtle) December 1, 2021

If you feel you need to correct a balance sheet account please contact the relevant central department to discuss the adjustment. If you are not sure which central department to contact, please contact General Accounting at They will advise accordingly. Below, you’ll find a list of some of the most common small business expense categories that can be deducted from your taxable income. Types of Expenses in Accounting Educating yourself about the common small business expense categories will make it much easier to determine what is and isn’t deductible at tax time. An example graph showing Company A’s revenue expenditures for June 2019. For the purposes of demonstration, we’ll say that the company implemented a revenue expenditure threshold of $5,000; anything above that is expensed differently.

Business Expense Categories For Small Businesses And Startups

Remember, if you’re looking for investors, outside financing, or need to create financial projections, you will have to have an accurate estimate of your regular business expenses, categorized properly. Applicant Tracking Choosing the best applicant tracking system is crucial to having a smooth recruitment process that saves you time and money. Find out what you need to look for in an applicant tracking system. Appointment Scheduling Taking into consideration things such as user-friendliness and customizability, we’ve rounded up our 10 favorite appointment schedulers, fit for a variety of business needs. CMS A content management system software allows you to publish content, create a user-friendly web experience, and manage your audience lifecycle. Expenses are used to produce revenue and they are deductible on your business tax return,reducing the business’s income tax bill. To be deductible, they must be “ordinary and necessary” to the business.

Therefore, all expenses are costs, but not all costs are expenses. The quantity and description of goods and services being transferred and how the receiving project benefited from the cost being transferred. The department should maintain a methodology statement to support their allocation process. In addition the department must maintain the appropriate records and usage logs to substantiate all charges redistributed. Transfers must be in the same amount as the original charge unless a portion of the expense is to be transferred.

Business Meals And Travel Expenses

These expenses are subtracted from gross profit to arrive at the net profit. Often extraordinary expenses are incurred due to one-off events. A recent example could be the expenses incurred due to the coronavirus pandemic. Also, companies might incur interest expense for borrowing money from banks or the issuance of bonds. Lastly, companies might also incur non-cash expenses in the form of depreciation & amortization. They are termed as fixed as they remain constant throughout and have to be paid regardless of any business activity.

Form 1-A/A XCPCNL Business Services – StreetInsider.com

Form 1-A/A XCPCNL Business Services.

Posted: Tue, 30 Nov 2021 19:35:12 GMT [source]

Accounting software also helps you to use the data from your expenses to run profit and loss reports. Doing so shows you the amount you’re spending in each category so you can assess whether you need to get your costs under control or if you’re on track. You can break down spending at specific time intervals to see how expenses change. These reports simplify the deduction process while revealing your annual business expenses. Business expenses are the costs of running a company and generating sales. Given that broad mandate, the IRS doesn’t provide a master list of allowable small-business and startup deductions. As long as an expense is “ordinary and necessary” to running a business in your industry, it’s deductible.

Revenue expenditures are usually less expensive than capital expenditures, small enough to be expensed against a shorter revenue period. Revenue expenditures expense in the current period, or shortly thereafter, and are consumed within a very short time. After this, they will bear no further effect on your expenses, unless they recur, in which case each separate recurrence is expensed separately.

There are two types of accounting methods. (1) Cash method: allows taxpayers to match income and expenses to the period in which cash receipts and payments occur. So, it recognizes transactions only when cash is exchanged.

— Finance Turtle (@ustaxturtle) December 1, 2021

Best Of We’ve tested, evaluated and curated the best software solutions for your specific business needs. When the processing fee is incurred but the good is not yet delivered, debit and credit . Securities in your account protected up to $500,000 (including $250,000 claims for cash).

Business Expenses Definition – Taxes – Investopedia

Business Expenses Definition – Taxes.

Posted: Sat, 25 Mar 2017 23:25:28 GMT [source]

Business entertainment expenses are not tax-deductible, but you’ll still want to track entertainment spending closely. Tickets to sporting events, galas, and networking events fall into this category.

- The Dean, Director or Chair of the department by assigning a role within the financial system is delegating the authority to approve these cost transfers and expenditure and revenue adjustments.

- Contact us for a copy of the fund prospectus and recent performance data.

- The responsibility for compliance with University and Federal regulations and guidelines and for maintaining supporting documentation for transfers/adjustments is in the originating department/unit.

- It may seem time-consuming to keep a log separating business and personal use, but you’re losing out on close to $600 in deductions.

- This category includes the cost of gasoline, airfare, and hotels.

- So if a company purchased a machine to produce goods, this is an expense that is being used to product a product to sell, which can be sold to generate revenue.

They can be hard to plan for, such as money needed for an unexpected machine replacement or repair. Allowable deductions are ones that are considered by the IRS to be both “ordinary and necessary”. This category is often seen as a drain on the revenue of many companies, as it is often abused. Be sure to create an approval procedure for your staff or have a good policy in place on what qualifies for this category. Perhaps simply having a rule where you sign off on on this type of request in advance is enough.

Author: Ken Berry