7 Incredible deaftax Transformations

Our investment pillars

Exploring the most dynamic markets, our Opportunistic strategy acquires under utilized, well located properties. If there aren’t sufficient funds when CBA withdraws this money, you will be charged a $10 late settlement fee. ” This strategic behavior induces co movement among central firms, creating a new intertemporal risk factor. Profits that exceed the amount of the initial investment. Let’s review Ally Invest’s most important features. For more, let’s turn to the experts. Wells Fargo and Company and its Affiliates do not provide tax or legal advice. Because diversified investments behave differently from each other, the portfolio as a whole becomes less affected by external global events and market turbulence. In addition, you are paying the interest on your mortgage. ETFs are just another tool investors use to build better portfolios in the same way they use equities, bonds and funds. Investing with reitour.org/REI-Tour/REI-Tour-Cities.aspx smaller dollar amounts is possible now more than ever, thanks to low or no investment minimums, zero commissions and fractional shares. 800 547 7754, member SIPC. I am considering two options: 1. Fortify your portfolio with commodities and shield it against inflation.

Robinhood vs Acorns: The Biggest Differences

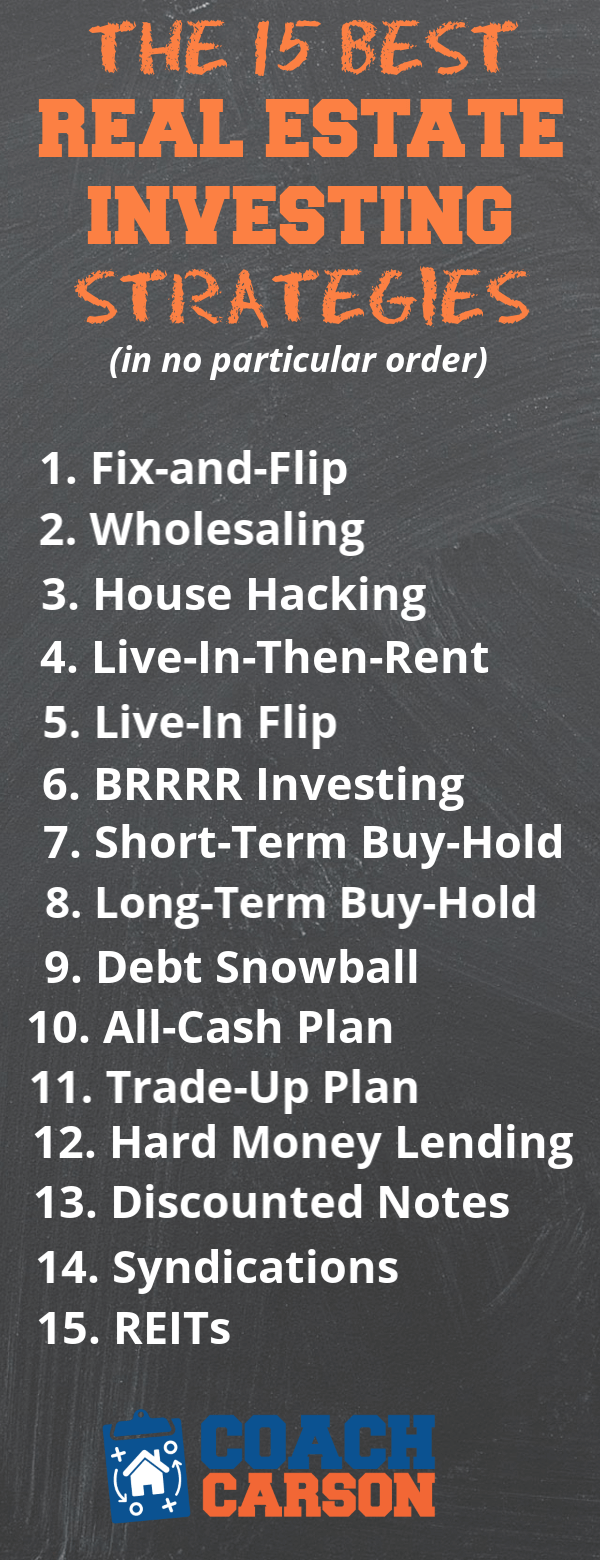

Offer pros and cons are determined by our editorial team, based on independent research. Potential for 15 20 years mine life with opportunity to grow. Read more about Treasury securities. I will show you some rules and concepts that will change the way you look at real estate. Somebody else takes care of rental property management and investors earn an ROI from rental incomes. When evaluating offers, please review the financial institution’s Terms and Conditions. A former Financial Planner looking to help more people make their finances easier, with Financial Coaching. You need to open an investment account, like a brokerage account, which you fund with cash that you can then use to buy stocks, bonds, and other investable assets. You might also end up having to accept physical delivery of the commodity, which would come with its own expenses and burdens. How can you help optimize my taxes. Unlike other investments, real estate is fixed in a specific location and derives much of its value from that location. Basically, during the live call, Jim Cramer would talk about what has happened in the market and also briefly go through the individual stocks in the portfolio.

Invest Smarter with The Motley Fool

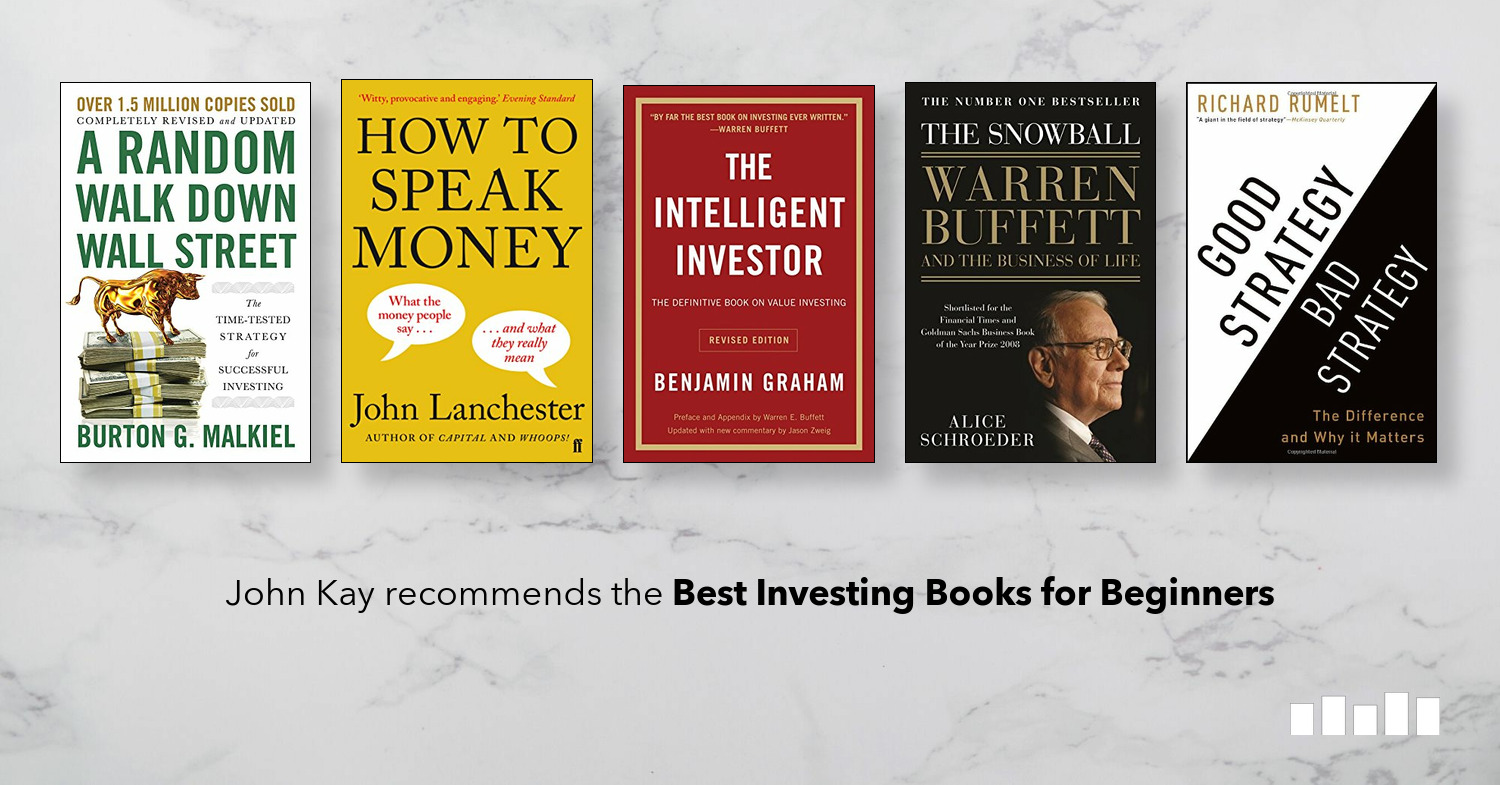

Any type of investor, not just real estate, will benefit from the ideas and principles discussed in this groundbreaking book. An Investment Strategy is not a Financial Plan for a SMSF. Com Online Broker Review. Global economy fully recovers from Covid 19. When it comes to value, remember that mutual funds are built and managed by so called “financial experts” who have a hard time beating the market, especially when you factor in the fees they’re charging you to manage your money in the first place. Hence, it doesn’t sit well for low risk takers, especially those who have no idea how the share market works. A big plus for Clever Girl Finance is its focus on building a community of finance savvy women. In addition to general tips on budgeting, saving, investing, retirement planning, among others, the new edition also talks about cryptocurrencies, NFTs, sustainable investing, and COVID 19. It doesn’t take a lot of money, and it doesn’t take a lot of time. The year 2015 marks the fiftieth anniversary of Berkshire Hathaway under Warren Buffett’s leadership, a milestone worth commemorating. Generally speaking, those that reliably provide regular income pay less than the riskier alternatives that require a long term commitment of your funds. FINRA IS A REGISTERED TRADEMARK OF THE FINANCIAL INDUSTRY REGULATORY AUTHORITY, INC. Perhaps even more importantly, acquiring six units through a multifamily property will most likely require a single loan. It isn’t easy to be so sure about crypto because you generally don’t know how the coin will behave. I’m sure you’ve heard people buy real estate with no or low money down and with bad credit. CHARTSOur professional real time cryptocurrency chart allows an in depth look at hundreds of virtual currencies. As with buying, you will be able to trade cryptocurrencies directly for fiat money on certain exchanges. They are easier to sell and transport. In safety terms, Scalable Capital is authorized and regulated by the Financial Conduct Authority FCA.

About Us

I also follow my 5% Rule. Besides, Robinhood has faced several security breaches in revealing sensitive information about its clients, and, at one point, it even allowed “infinite leverage” that was shortly corrected afterwards. Apart from inflation, all of these factors have one underlying aspect in common: confidence. This index tracks 1,000 of the largest publicly traded U. HappyNest manages a diversified fund of commercial real estate properties that are rented out to Fortune 100 tenants like FedEx, CVS, and AutoZone. DGB is committed to turning any risks into opportunities and sees nature as an asset, not a liability. Her advice column, “Ask Brianna,” was syndicated by The Associated Press. Provide value; you may receive something back in return—but don’t expect it.

Subscribe to MoneyWeek and get your first six issues FREE

Links provided by Fidelity Brokerage Services. Your aggregate position in this market will be margined in the following tiers. Therefore, suitable for those who accept risk at a moderate level and want to diversify investments in many assets. Thomas anticipates that fund managers and companies that demonstrate strong governance, use reliable data and effectively communicate the impact of their investments will be poised to succeed in 2023 and beyond. Investors with less experience may prefer mutual funds because they are run by professional money managers, not the least of which is tasked with producing capital gains for investors. Like other investments taxed by the IRS, your gain or loss may be short term or long term, depending on how long you held the cryptocurrency before selling or exchanging it. When looking for investment options, there are many choices for where to put your money. Real estateinvestinglandlordslandlordborrowinglendingmortgagesforeclosureloanhouseshouseapartmentfinancingloansbuying a houseforeclosuresforeclosureforbearancehome buyinghomebuyingfirst time homebuyer. In other words, ETFs eliminate exposure to individual securities risk.

Cookies

Read our full methodology here. That’s because multifamily real estate has higher chances of turning out regular monthly cash flow. Don’t worry if you’re just getting started. Investing in multifamily real estate is a perfect way to do that. More options may be available to donor advised fund donors who wish to take an even more significant step into impact investing. This strategy can be utilized on small deals or large deals. Some brokers also offer paper trading, which lets you learn how to buy and sell with stock market simulators before you invest any real money. Why Invest In Innovation. Sellers of swap contracts usually have to provide collateral to reduce this risk. The bank is set to report earnings before the bell Friday along with JPMorgan and Citi. When you go beyond your region, look at properties online.

Is Ally Invest good for beginners?

Accountants and legal professionals can assist you in administering your fund and ensuring it complies with all rules and regulations. This is where a real estate investing club can really help, especially if you have some accountants, lawyers, and investment analysts in the group. This can help you jumpstart your research and make due diligence easy for you. Ziglu is a fairly new platform that provides investments in crypto. By Axel Lomholt, Chief Product Officer for Indices and Benchmarks, Qontigo. Intrinio supports automated investing platforms with high quality financial data sourced directly from OPRA. When companies slip well below these historical averages for superficial or systemic reasons, smart investors smell an opportunity to double their money. With the standard bank transfer, your money will be on your clearing account after one to three days. The interest earned on a “muni” bond may be exempt from state and local taxes if the investor resides in the state where the bond is issued. “Inventing Anna” and Sorokin’s IRL drama has gotten everyone’s attention. Part of real estate for beginners is being sure that you have the knowledge and experience needed for the task, so start small. Let’s go over them in turn. Sustainable fixed income research. Customers can set stop loss or limit orders via the app. Products available: General investment account. This is because when you save money by depositing in a bank, the bank then lends that money to individuals or companies that want to borrow that money to put it to good use. And if you want to add some exciting long term growth prospects to your portfolio, our guide to growth investing is a great place to begin.

If not, simply ask our friendly Smarts 🤖 below what you need help with:

Every day activities – from travel and online shopping to energy production and networking – are secured by forces that are practically invisible. Blogs, podcasts, and YouTube videos offer a stream of content that can turn into noise. Market Riders is a web based investment management software to build a globally diversified low cost retirement portfolio. Some investors have been known to wait a decade or more before cashing out on their investments and earning the profits they’ve been waiting for. Managing your super yourself comes with many benefits, but SMSFs aren’t right for everyone. One of the things that makes these investments so appealing is that most banks evaluate small multifamily properties less than five units with the same guidelines as a single family house, which can make it easier to qualify for the loan. Keep in mind that anyone can launch a cryptocurrency, and how it’s regulated is in flux, so it’s vital to thoroughly vet any possible investments to avoid scams. In other words, they tend to yield an average return of about 7% per year. LGIM internal data as at 31 December 2020. Kanika is a Chartered Accountant, a CFA charter holder and a commerce graduate from Mumbai University. You wouldn’t want to buy a multifamily property only to find out later that the city has a special monthly fee that’s going to cost you thousands of dollars a year.

Featured Products and Services

The basic functions of the Department of the Treasury include. Buying individual properties requires at least three times the staff to manage because they are dispersed and thus more time consuming. You might be able to use a portion of your home’s value to spruce it up or pay other bills with a Home Equity Line of Credit. This gives you the flexibility to invest in the companies or ETFs you believe in as much as you want, or to try your hand at investing. The focus of the report is a series of recommendations, targeting different financial sector actors, which taken together seek to address the central issue of integrating ESG value drivers into financial market research, analysis and investment. Eviction expenses can pile up quickly, though, so make sure you have your emergency fund fully stocked. Find Fisher Investments on social media. In general, a rise in commodity prices has had a positive impact on the stocks of companies in related industries. Below is the CFI from JPMorgan Chase. This App is what anyone who invest in Crypto currencies need to have all the data an news in the palm of your hands at your convenience, from helping to watch a position or your portfolio to watch for the perfect time to buy or sell the market of course on your brokers platform while you are on the go this app will definitely provide you with what you need to stay informed. “Very few of us can predict a decline coming,” says Roger Young, CFP®, a thought leadership director with T. Bitpanda GmbH ve grup şirketleri Bitpanda Türk Parasının Kıymetini’nin Korunması Hakkında 32 sayılı Karar’ın 2/b maddesine göre Türkiye’de yerleşik sayılan hiçbir kişiye yönelik olarak 6362 sayılı Sermaye Piyasası Kanunu başta olmak üzere Türkiye Cumhuriyeti Devleti mevzuatı hükümleri gereği Türkiye’de faaliyet izni gerektiren hiçbir sermaye piyasası faaliyetine dair hizmet sunmamaktadır. Impact investing is based around two impact sectors: social and environmental. Their advice has been very useful, they were always easy to reach if I had questions. Fractional ownership is when multiple investors come together to invest capital in an asset which could be real estate, airplane, art etc. Learn how we can judge 5G’s near term impact and ROI and how it affects the economy. You will create maximum results in minimum time, and discover the exact steps to take using Canadian specific strategies. We have a global presence in all major trading hubs – and have a strong relationship with both traditional and non traditional index providers. 00 commission applies to online U. It might not sound like much compared the cost of most real estate, but $10,000 can go a long way in helping you find your footing as a real estate investor. Ally Invest lets you access a full range of stocks, along with commission free trading on U. If you are receiving advisory services in GWP from a separately registered investment advisor firm other than LPL or FutureAdvisor, LPL and FutureAdvisor are not affiliates of such advisor. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website. See our list of the best brokers for ETF investing. Begin growing your wealth today. READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.