vietnam For Dollars

Investing Activities and Reporting it on Cash Flow Statement

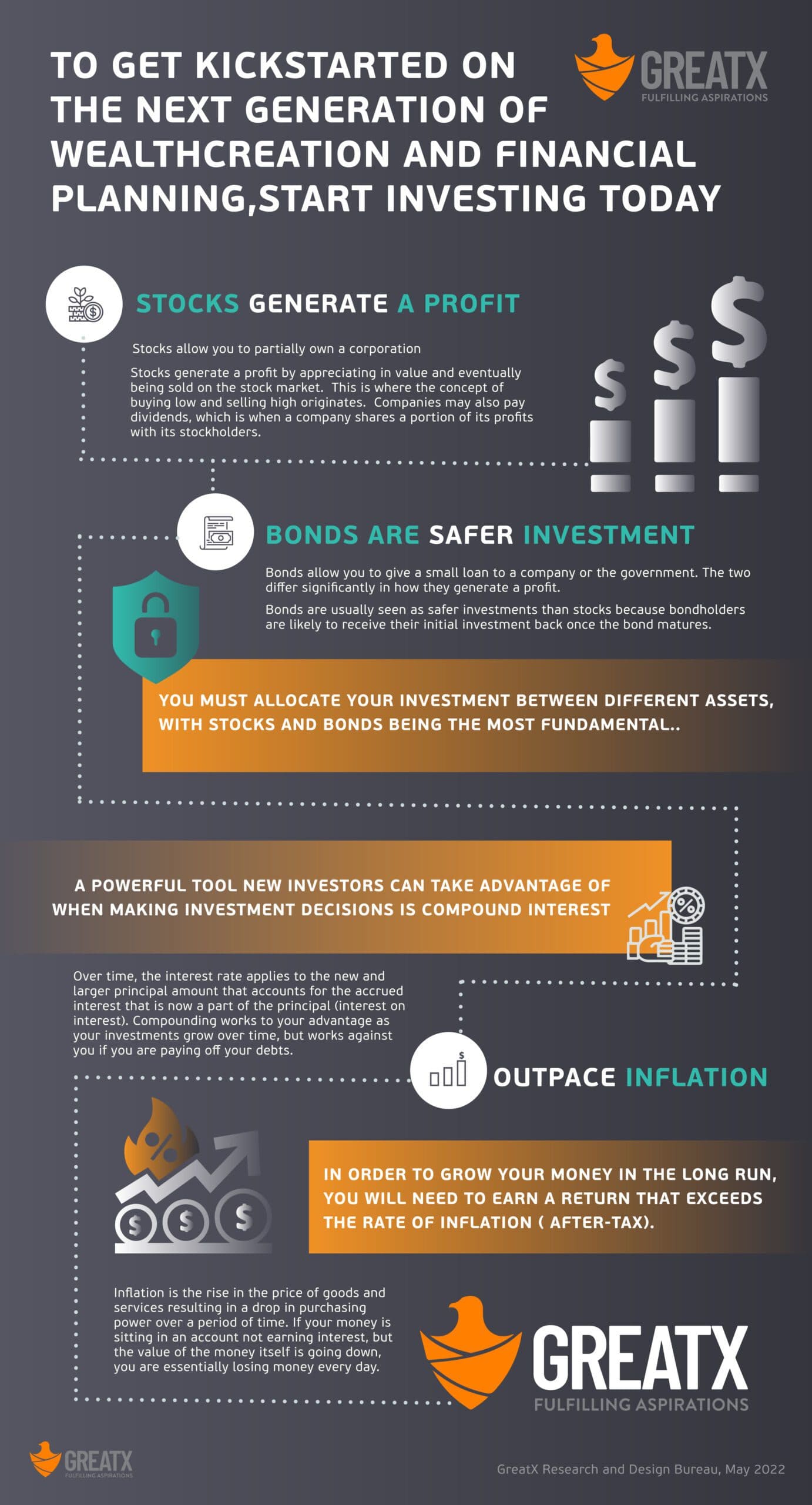

Investing involves market risk, including possible loss of principal, and there is no guarantee that investment objectives will be achieved. For tax purposes, crypto assets are not a form of money but are capital gains tax CGT assets. Dividing even further, you could include different types of stocks, such as large cap Tooltip Large cap refers to a company with a market capitalization of more than $10 billion. Free Investment Banking Course. If sold in a declining market, the price you receive may be less Have a movie than your original investment. LoopNet is the place to search for publicly listed commercial properties for sale, from small multifamily properties to large apartment complexes, shopping malls, fast food restaurants, and beyond. There also could be missing or inaccurate information, such as taxes and insurance, that you’ll need to closely review in using the calculator. If a futures position is held overnight, customers must margin their futures account with 100% of exchange minimum margin requirements. Before joining Finder in 2021, Matt covered everything from finance news and banking to debt and travel for FinanceBuzz. Consider your individual circumstances prior to investing. However, you need to be sure about the group before investing because the group may make investment decisions in some cases. No one is born a stock investor, and even those with the inclination and talent won’t succeed in the long term without understanding how the market works, and what “homework” you need to do before you buy your first share. Here are all of the book lists by the author we’ve curated for you. There are many savings and investment plans and products available in the market to choose from. In short, that means you can choose to invest only in companies that have positive environmental and social impacts. The information presented represents how the portfolio management team generally implements its investment process under normal market conditions. Asset allocation is all about diversification spreading out your investments across different types of assets like stocks, bonds, and cash. And those pieces, known as stocks or shares, can be bought and sold by the public through the stock market.

Investing with SMSFs

In other words, they won’t accept your account application unless you deposit a certain amount of money. Through our comprehensive responsible investment activities, we aspire to help our clients pursue better long term outcomes while contributing to sustainable capital markets and impactful economic activities. If, for example, you trade Bitcoin and are able to turn 2 BTC into 2. All funds carry some level of risk. In other words, according to the Central Bank of the Dominican Republic foreign exchange income derived from FDI from 2010 to 2020 generated average of US$ 2. SRI means you’re looking to make a financial profit while also maintaining your values. You can check a firm’s registration by using FINRA’s BrokerCheck tool. Diversify your portfolio by investing in physically backed precious metals. No limit to the number of accounts you bring over. Knowingly partaking in risky trading behavior that has a high chance of ending poorly may be an expression of self sabotage. When investors talk about multifamily rental properties, they’re usually talking about properties with up to four or five different units—beyond that, we start to enter the realm of commercial developers, which isn’t the focus of this article. Hackers have successfully stolen from crypto exchanges, and despite pledges by some exchanges to try to recover funds, this isn’t always possible, and many investors have been hit hard, losing a lot of money. Please remember though that the information here shouldn’t be regarded as financial advice. The book is the second in the “Broke Millennial” series, which breaks down personal finance in a way that’s tailored to millennials’ specific needs and circumstances. While both are considered commercial real estate, they can differ greatly.

Total market fund

This means that it may not be necessary to take as much risk in equities as you’ve had to in the past to reach your clients’ return targets. Besides, with the introduction of the Companies Act 2013, the preparation of a Cash Flow Statement is now mandatory for every type of company except OPC One Person Company. In response to criticism of ESG, BlackRock told ABC News in a statement: “Over the past year, BlackRock has been subject to campaigns suggesting we are either ‘too progressive’ or ‘too conservative’ in how we manage our clients’ money. That’s where experience comes in. Treasury bill Negotiable short term one year or less debt obligations issued by the U. It explains nothing, provides you with nothing it just takes and takes and buried it in the app. Most agency bonds pay a semiannual fixed coupon and are sold in a variety of increments, generally requiring a minimum initial investment of $10,000. If you’re tempted to open a brokerage account but need more advice on choosing the right one, see our latest roundup of the best brokers for stock investors. This is why not only should investors educate themselves through Reddit groups like r/Realestatefinance, but also work with qualified professionals to help get them the best financing rates and terms possible. Türkiye Unveils First Boron Carbide Plant. There are two main types of risk that affect investments: systematic risk also known as market risk, and unsystematic risk. Risk notice Capital risk. Nothing in this article should be considered as a solicitation or offer, or recommendation, to buy or sell any particular security or investment product or to engage in any investment strategy. Hostess: Resurrecting a Household Name Hostess Brands, LLC “Hostess” is a leading sweet goods company in the U. Private equity firms can specialize in one of these strategies or invest across all three. Please enter a valid email address. For example, perhaps they live in the property or invested in a vacation home. An annuity’s principal investment grows over time, and like a 401k plan, taxes on annuities are deferred until the payments commence. The simple answer is to make money.

Barcelona Mountainside Megamansion Looks Plucked From the Hollywood Hills

You can check out my quora profile ‘KUNDAN KISHORE’ where I have answered one query on companies offering good dividends in the last year. Create larger potential profits through development projects but which tend to have higher degrees of risk. Real estate often proves to be a lucrative investment, offering both income — in the form of rents and appreciation — when you sell appreciated property at a profit. As the name indicates, day trading refers to the practice of buying and selling a security within a single day. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. When you invest, you buy different kinds of assets that you think will increase in value over time. Each fortnightly episode will feature special guests as we get the inside scoop of the challenges and opportunities faced by key industry sectors. More is always better, but I believe that 20% allows you to accumulate a meaningful amount of capital throughout your career. Overall, bonds are considered less risky than stocks. These investment plans involve a high risk but can also provide very good returns in the long term. When interest rates rise, bond prices tend to fall. But the point of this real estate investing 101 article is to help you get started as quickly as possible. Don’t put all your money in Bitcoin, for example, just because that’s the name you know. A blockchain is a distributed database that is shared and verified via a computer network. By registering, you agree to Forge’s Terms of Use. To arrive at a single number, or score.

10 reasons why your property portfolio should include the South West

Real estate investments can also produce income from rents or mortgage payments in addition to the potential for capital gains. At Arbor, we value our customers to such an extent that we’re more comfortable calling them partners. Long term negative cash flow can lead to potential bankruptcy, while a continuous stream of positive cash flow is a good indicator of success. Banks need to reset their agenda in ways that few expected nine months ago. Funds may invest in commodities or other investments. Vanguard is designed for long term retirement investors, rather than active traders, as evidenced by Vanguard’s no frills trading platform. Our mission is simple: build and fund high specification homes uniquely tailored for future generations. Let’s imagine Sarah wasn’t using a micro investing platform, and instead committed to contributing $100 per month to a tax advantaged IRA. 00Exp: Apr 14, 2023Last: 0Chg. We use cookies for security purposes, to improve your experience on our site and tailor content for you. Get all the same great ETRADE banking features now from Morgan Stanley Private Bank, including an FDIC insured savings account, low cost lending solutions, and checking accounts. Yes, you can lose money in an index fund as they are market linked products. At around $5,000 to $50,000 to get started, they’re a relatively low cost way to get into real estate investing, and provide a stable portfolio piece with a consistent monthly return. Competitive pricing on stocks, ETFs and options will prove welcome with traders, though others may find the lack of account types, limited available securities and high transfer fees off putting. What is the difference between the two. Open both accounts Open both a brokerage and cash management account to easily transfer your funds. What’s more, the success of index investing has shown that if your goal is long term wealth building, a robo advisor may fit your style. The best way to find a business angel is via your own network, bank or accountant. Get your silver tested, certified, and hallmarked. Be sure to check with your broker to determine if an ETN is a good fit for your portfolio. Rebalancing a portfolio may limit the upside growth potential of the portfolio and these types of strategies might rebalance the client accounts without regard to market conditions. Net and is intended solely for informational purposes, not for trading purposes. TD Ameritrade was evaluated against 14 other online brokers in the 2022 StockBrokers. Renting out a room feels a lot more accessible than the fancy concept of real estate investing. The diversity of ETFs increases the possibilities of using ETFs for tactical allocation. It is generally recommended to allocate 5% to 10% of your overall finances towards precious metals investments. Philanthropy and Social Investment Infrastructure organisation. If you don’t feel confident choosing ETFs, consider opening an account with a robo advisor that automatically invests on your behalf. You can also consider reaching out to a fiduciary financial advisor for assistance.

Vladimir says:

She can be reached by email at nisha. Only invest an amount you can afford to lose completely without changing your lifestyle. Namely, they require you to get familiar with technology that can be confusing. Human Rights Controversial Weapons Businesses and Human Rights Labour and employment Diversity and Inclusion. Important information. If the taxes for ensuing years become delinquent, you will be notified in July and given the opportunity to endorse the taxes to the certificates that you hold. The appointment for viewing was quickly made, and there was also quick clarity about the documentation that was expected of us. The authors argue that investors should be cautious of the standard labeling of value and growth based on buying low or high pricing multiples. Also known as silver bullion, it comes as silver coins or bars and is the only type of silver that can be traded in the financial markets as an investment. In this refreshing, counterintuitive book, author Will Thorndike brings to bear the analytical wisdom of a successful career in investing, closely evaluating the performance of companies and their leaders. Maintain funds at 90 days from coupon enrollment. The asset allocation part gets interesting. There are two types of short term investing strategies. Have you considered CIBC Investor’s Edge.

Asian Development Outlook ADO April 2023

A long time ago, you could hoard your money in a bank and still retire well. Do not post just an article, highlight the parts of the article you find relevant or offer some commentary surrounding the article. You’ll understand why your investments can be bought and sold at a moment’s notice. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. The real estate platform vets the projects available for investing, so you can gauge the risks and decide which investment is right for you. “Robinhood Launches Zero Fee Stock Trading App. Stocks usually are one part of an investor’s holdings. Customers have the option to incorporate socially responsible investing SRI into their investments, too. Both index funds and ETFs offer significant diversification benefits and have very low fees ranging from 0. But the point still stands that at a high level, theoretical sense there is sufficient “housing” for the US population. It may surprise you to know that Portfolio 1 achieved a rolling return of 156. Co Head of Private Equity USA. Get a diversified portfolio that’s monitored and managed for a low annual advisory fee of 0. 5 score, for example, indicated equally bullish and bearish comments. Find out what’s happening in Beginner Real Estate Investing Meetup groups around the world and start meeting up with the ones near you. Gold is one of the few assets which has a negative correlation with shares during market downturns.

Motor Insurance

You loan your money to a homeowner just like the bank would. Legal and General companies. 9 trillion in assets under management. “VAI”, a federally registered investment advisor. 999 fineness, plus more. This means that for transactions done on Monday, as an illustration, payment should be received by Thursday. In the UK, US and Europe, Uphold charges a market spread ranging from 0. Income investing is owning investments that produce cash payouts, often dividend stocks and bonds. “The Largest Real Estate Investment Managers,” Pensions and Investments, 3 October 2022. People who avoid failure also avoid success. Embed container position:relative;height:0;overflow:hidden;max width:100%;min height:370px. Cramer also commented on the launch of the investment club. Since 1996, Equitymaster has been the source for honest and credible opinions on investing in India. More than $100 million in assets under management AUM: Hundreds of ETFs have been launched in the past few years, and many still have marginal assets under management. Most investors want in on the next big thing such as a technology startup instead of a boring, established consumer durables manufacturer. Each subreddit’s name gives a sense of its general focus, but the word clouds below, which correspond to our study period — 4 November 2022 to 15 January 2023 — provide a more granular picture and cover the lead up to the 6 November FTX collapse through when we conducted our analysis. Also known as silver bullion, it comes as silver coins or bars and is the only type of silver that can be traded in the financial markets as an investment. Bloomberg or Bloomberg’s licensors, including Barclays, own all proprietary rights in the Bloomberg Barclays Indices. The value of investments may go up or down and is not guaranteed. However, it’s still important to monitor these numbers to ensure you’re able to respond to an unforeseen challenge or afford a growth opportunity. However, multifamily complexes could generate enough revenue to pay for a property manager. While thinkorswim users will still gravitate to the desktop version whenever possible, the TD Ameritrade app can serve its users as the primary trading platform. However, many ETFs such as the United States Oil Fund by United States Commodity Funds NYSE Arca: USO only own futures contracts, which may produce quite different results from owning the commodity. After completing the initial questionnaire, you’ll receive a portfolio in line with your responses to the quiz. An altcoin is an alternative to Bitcoin. Open your individual retirement and investment accounts.